Homeowners Insurance in and around San Jose

If walls could talk, San Jose, they would tell you to get State Farm's homeowners insurance.

Apply for homeowners insurance with State Farm

Would you like to create a personalized homeowners quote?

- Evergreen

- Milpitas

- Bay Area

- Fremont

- Santa Clara County

- Santa Cruz County

- California

Welcome Home, With State Farm Insurance

When you’ve worked a long shift, there’s nothing better than coming home. Home is where you take it easy, kick back and laugh and play. It’s where you build a life with family and friends.

If walls could talk, San Jose, they would tell you to get State Farm's homeowners insurance.

Apply for homeowners insurance with State Farm

Open The Door To The Right Homeowners Insurance For You

Rose Mary Nunes will help you feel right at home by getting you set up with great insurance that fits your needs. Protection for your home from State Farm not only covers the structure of your home, but can also protect treasured items like your favorite chair.

Don’t let fears about your home keep you up at night! Contact State Farm Agent Rose Mary Nunes today and explore how you can benefit from State Farm homeowners insurance.

Have More Questions About Homeowners Insurance?

Call Rose Mary at (408) 532-6680 or visit our FAQ page.

Protect your place from electrical fires

State Farm and Ting* can help you prevent electrical fires before they happen - for free.

Ting program only available to eligible State Farm Non-Tenant Homeowner policyholders

Explore Ting*The State Farm Ting program is currently unavailable in AK, DE, NC, SD and WY

Simple Insights®

Help protect your home against common causes of house fires

Help protect your home against common causes of house fires

Devastating home fires are an unfortunate reality. Learn about the causes of house fires and precautions to help prevent a fire before it starts.

How to prevent bug bites

How to prevent bug bites

Spider and insect bites take the fun out of being outside. Discover ways to help avoid them and what to do if you get one.

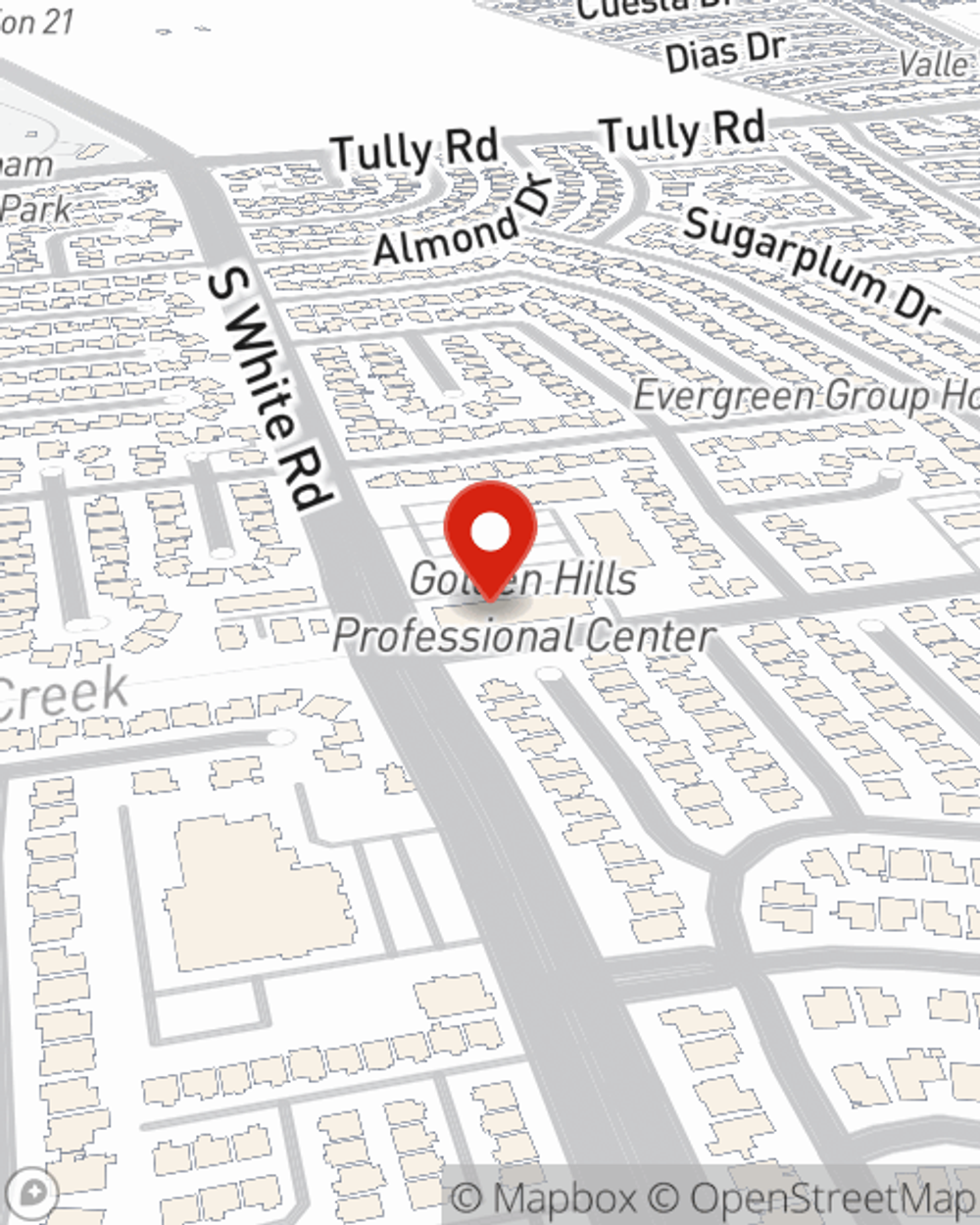

Rose Mary Nunes

State Farm® Insurance AgentSimple Insights®

Help protect your home against common causes of house fires

Help protect your home against common causes of house fires

Devastating home fires are an unfortunate reality. Learn about the causes of house fires and precautions to help prevent a fire before it starts.

How to prevent bug bites

How to prevent bug bites

Spider and insect bites take the fun out of being outside. Discover ways to help avoid them and what to do if you get one.